What is market research and why do companies use it?

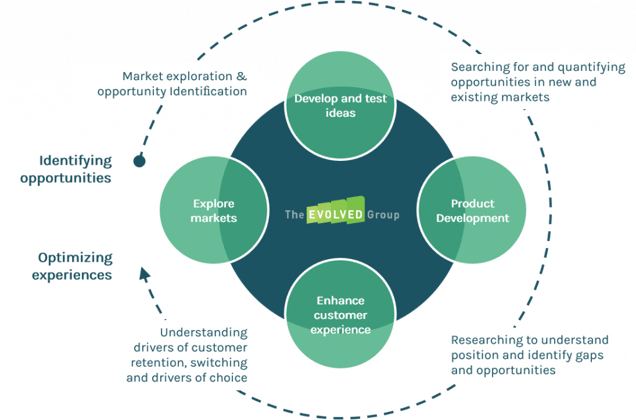

When asked “what does Evolved do?”, we often reference the diagram below and give the answer ‘identify opportunities and optimise experiences’ for our clients.

More directly, the question ‘why do companies do research?’ can yield very obvious answers. For example, organisations do CX research to track customer satisfaction. It’s obvious – they want to deliver a better experience or product because it will drive repeat purchase or growth opportunities. FMCG companies research new products and test formulations to bring products to market so they can gain consumer share and make money. By testing the products, they avoid costly product failures in market.

To unpack the question further into a more thoughtful response, let’s ask ‘what drives companies to undertake market research instead of alternatives’ – especially in the modern era of insights where there are countless ways to obtain insights.

Before I do, I might as well get the obvious answers out of the way:

- Customer Experience – need to keep my customers happy and loyal

- Employee Experience – need to have happy, healthy and engaged team members

- Brand Research – need to have a strong brand that will attract customers and employees

- Communications development – need to ensure I’m clearly communicating key messages that resonate with my target market

- Pricing Research – need to know how much to charge for my products

- Segmentation & Persona Research – need know who to sell my stuff to and what they want

- Product Development – need to know what products to retain, develop and create

- Market Sizing – need to know the size and fragmentation of the market to know where to operate

And before we jump into more thoughts on this, some definitional hygienics – when I say market research, I mean obtaining information that answers questions about customers and markets used to support decision-making. It isn’t a perfect definition, but it will do. There are couple of key words in there:

- Information – we could be talking about desk research, primary qualitative or quantitative research.

- Customers or markets – this is important. When I say markets, I mean that research is often undertaken with non-customers – that is the people you want to be customers that you often don’t know a lot about because they are not customers.

- Decision-making – all sorts of decisions are made in companies and often the right decision is to do nothing. For example, getting regular feedback to front of house employees on their service delivery may result in the decision that they are fabulous and no action is required. On the other hand, a decision could be to launch or not launch a product, expand a range or reformulate a product. For the purposes of this discussion, I am not talking about employee engagement research, however, talking with employees about customers is in scope.

Businesses are complex places. The bigger they get, the more complex they become. There are more people in management roles and behind the scenes who don’t have regular contact with customers, but who support customer-facing people and processes. Also, the ability to be agile, listen to customers, and respond to their needs becomes harder as processes becomes locked in and lines of management lengthen.

In professional services companies, Account Managers, Salespeople and Service Delivery teams have regular contact with customers. But those relationships are often procedural, anchored in delivery of the goods or services, or filtered by a mutual desire to avoid issues because it may ‘upset’ the relationship. Generally, listening objectively to customer feedback is not peripheral to delivery of needs.

1) Focusing on the “why”

In larger companies, feedback comes through complaints, customer enquiry lines and more recently, social media monitoring. These sources provide some insights about customers, but they are always self-selecting. In other words, the feedback is not representative. Also, the insight is grounded in today’s delivered experiences and does not allow exploration of potential experiences i.e. we study data and what people say about how things are now but are left wondering about their responses to how things could be.

These sources of knowledge also generally don’t provide insights into the underlying needs, motivations or drivers of customer behaviour. They reflect what people do and say, not why. By understanding people (consumers, customers, markets) in their own terms, and focusing on the ‘why’, organisations can identify opportunities to serve them better through extrapolation of those needs to solutions.

A lack of information creates uncertainty about what actions to take. It’s this uncertainty that drives the need to fill the knowledge vacuum with something that managers can get their heads around and reduce anxiety. That anxiety is often driven by their individual goals in the business, which always come down to customer retention, growth and acquisition.

Research is motivated by the individual’s desire to fill information gaps that lead to anxiety.

Focusing on CX, the anxiety is anchored in the implicit (and correct) belief that unhappy customers are going to leave, spend less or discourage others from using a product or being a customer. Social media amplifies these anxieties.

Often the trigger to invest in research is churn, where the cause is unknown. Perhaps a less negative interpretation is that the manager can be motivated to achieve a score. This score must be obtained and the only way to measure it is with primary research, that is ask the customer. Of course, well delivered research delivers a whole lot more than the score; it also provides the context, the explanation, the recommended actions to drive it higher.

2) Innovation and development at a lower cost

Let’s consider other situations. Product testing. This one is quite different. Most private sector companies, have one goal – create value and generate income for shareholders. In the world of business, the competition keeps businesses on their toes with a need to constantly do better, innovate, ideate and progress. If you are not familiar with the theory, the best exponent of this was Schumpeter – you can read more about it here. Here is the key line:

“A great part not only of existing production, but also of previously created productive forces, are periodically destroyed.”

Fast Moving Consumer Goods (FMCG) is called ‘fast’ for a reason. It is not just that the products move off the shelves quickly, it’s also because the categories move quickly. Consumer tastes change or are changed by competitor actions. Manufacturers must constantly innovate to maintain their relevance and justify their shelf space. The whole basis of our Western capitalist economy is GDP growth, which requires innovation and improvement over time.

Creating new products is an expensive business. Only a minority of new products succeed and the cost of launching a market failure can be crippling. So, the ‘rock’ is do nothing and become irrelevant, and the ‘hard place’ is to constantly innovate and risk eating into profit through failed initiatives. Research allows innovation, progress and development at a lower cost of failure. Once again, the people in companies that are making choices are mitigating their risks by using research to avoid mistakes. The more positive lens is that they are maximising their changes of payoff by avoiding oversights or incorrect assumptions.

3) Understanding ROI and brand equity

One more example – brand research. Brands are intangible assets that have very tangible impacts on the bottom line. Spending money on advertising, marketing and communication entails an element of faith because the results are uncertain, often delayed and measured indirectly. The greatest challenge in understanding effectiveness of advertising is measuring ROI and attribution to spend.

So, understanding the value of a brand and the impact of investment in it, fulfils the same motivations for CX and product research; reduce anxiety about misallocating dollars and validating that the spend was worth it! Once again, there are strong benefits that arise through this process in identifying insights about where ROI is greatest, which channels are driving brand equity and how brand equity is converting into preference and why.

I will conclude by thinking about the assets research creates. This article that we recently had published in ESOMAR’s Research World sets out some questions that deserve deep consideration about the nature of what research is doing and how it is changing. The thesis is that research is changing and AI is creating new value that is not time-bound. In this new world, undertaking research adds to the corpus of knowledge in a way that potentially creates new ways to learn, especially through simulation or human-to-data interactions mediated by AI. Just as creative destruction drives our clients to invest in research and keep increasing the quality and relevance of what they do, so is this force in disrupting our industry and why clients spend money on research. That is, an increasingly important reason is to build better models.

Find out more

To find out more about how Evolved Thinking can help your business with CX, branding, product testing, segmentation or any other research strategy, contact us here or feel free to shoot me a message via LinkedIn.